Understanding Lifetime Customer Value shines a spotlight on the key metrics that drive business success, offering a fresh perspective on long-term profitability and sustainable growth. Get ready to dive into the world of customer value like never before!

Let’s explore the essence of LCV, from its definition to the strategies that can help businesses thrive in a competitive market landscape.

Defining Lifetime Customer Value

Lifetime Customer Value (LCV) is a crucial metric that businesses use to determine the total revenue they can expect from a customer throughout their entire relationship with the company. It helps in understanding the worth of each customer and guides marketing strategies and customer retention efforts.

Calculating Lifetime Customer Value

There are various ways to calculate Lifetime Customer Value, depending on the industry and business model. Some common methods include:

- Sum of all purchases made by a customer over their lifetime

- Subtracting the costs associated with servicing that customer

- Multiplying the average purchase value by the average number of purchases in a year and then multiplying that by the average customer lifespan

Significance of Understanding LCV

Understanding Lifetime Customer Value is essential for long-term business growth as it helps in:

- Identifying high-value customers and focusing on retaining them

- Optimizing marketing strategies to attract more customers with similar characteristics

- Calculating return on investment for customer acquisition and retention efforts

Factors Influencing Lifetime Customer Value

Customer Lifetime Value (LCV) is influenced by various key factors that play a crucial role in determining the overall value a customer brings to a business over their lifetime. These factors include customer retention, average purchase value, and customer acquisition cost. Let’s delve into how these factors, along with customer behavior, loyalty programs, market trends, customer satisfaction, and brand reputation, impact LCV.

Customer Retention

Customer retention is a vital factor influencing LCV as it focuses on keeping existing customers engaged and loyal to the brand. By maintaining strong relationships with customers and providing exceptional service, businesses can increase the likelihood of repeat purchases and long-term customer value. Retaining customers is often more cost-effective than acquiring new ones, making it a key driver of LCV.

Average Purchase Value

The average purchase value refers to the amount of money a customer spends on each transaction. Increasing the average purchase value can positively impact LCV by maximizing revenue generated from each customer interaction. By upselling or cross-selling products, businesses can increase the average purchase value and ultimately enhance the overall lifetime value of a customer.

Customer Acquisition Cost

Customer acquisition cost represents the expenses incurred to acquire new customers. High acquisition costs can significantly impact LCV by reducing the overall profitability of each customer. By optimizing marketing strategies and focusing on acquiring high-value customers with lower acquisition costs, businesses can improve the LCV and maximize the return on investment.

Customer Behavior and Loyalty Programs

Customer behavior, such as purchase frequency, product preferences, and engagement with the brand, directly influences LCV. By analyzing customer data and tailoring marketing strategies to meet the specific needs of customers, businesses can enhance customer loyalty and increase the lifetime value of each customer. Loyalty programs also play a crucial role in fostering customer loyalty and incentivizing repeat purchases, further boosting LCV.

Market Trends

Market trends, consumer preferences, and industry shifts can impact LCV by influencing customer purchasing behavior and brand perception. Businesses need to stay attuned to market trends and adapt their strategies to align with changing consumer demands to maintain a competitive edge and maximize LCV.

Customer Satisfaction and Brand Reputation

Customer satisfaction and brand reputation are essential factors in determining LCV. Satisfied customers are more likely to become repeat buyers and brand advocates, contributing positively to the overall lifetime value of a customer. By delivering exceptional customer experiences, building a strong brand reputation, and fostering trust with customers, businesses can increase LCV and drive long-term growth.

Calculating Lifetime Customer Value

Calculating Lifetime Customer Value (LCV) is essential for businesses to understand the long-term financial impact of their customers. By determining the value each customer brings over their entire relationship with the company, businesses can make informed decisions on marketing strategies, customer retention efforts, and overall profitability.

Different Methods Used to Calculate LCV

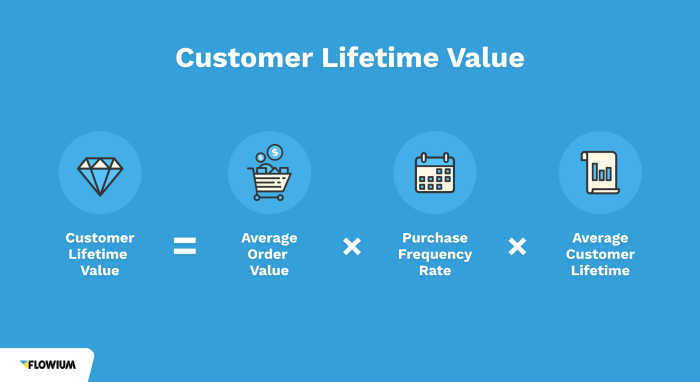

- The Simple Formula: One common way to calculate LCV is by using a basic formula. This formula typically involves determining the average purchase value, the average purchase frequency, and the average customer lifespan.

- More Complex Models: Some businesses may opt for more advanced models that take into account factors like customer acquisition costs, retention rates, and discount rates. These models provide a more nuanced understanding of LCV but require more data and analysis.

Step-by-Step Guide for Calculating LCV

- Step 1: Gather Data – Collect information on average purchase value, purchase frequency, customer lifespan, acquisition costs, retention rates, and discount rates.

- Step 2: Calculate Average Purchase Value – Divide total revenue by the number of purchases to find the average purchase value.

- Step 3: Determine Purchase Frequency – Divide the total number of purchases by the number of unique customers to calculate purchase frequency.

- Step 4: Estimate Customer Lifespan – Analyze historical data to determine the average lifespan of customers.

- Step 5: Calculate LCV – Multiply the average purchase value, purchase frequency, and customer lifespan to obtain the Lifetime Customer Value.

Importance of Accurate Data Collection and Analysis

Accurate data collection and analysis are crucial when calculating LCV. Inaccurate or incomplete data can lead to incorrect estimations of customer value, resulting in misguided business decisions. By ensuring data integrity and conducting thorough analysis, businesses can gain a precise understanding of LCV and make strategic choices to enhance customer relationships and drive long-term profitability.

Maximizing Lifetime Customer Value: Understanding Lifetime Customer Value

To maximize Lifetime Customer Value (LCV), businesses can implement various strategies aimed at increasing revenue from each customer over their lifetime. By focusing on personalized marketing campaigns and enhancing the overall customer experience, companies can build long-term relationships and loyalty with their customer base.

Role of Cross-Selling, Upselling, and Subscription Models

- Cross-Selling: Encouraging customers to purchase related or complementary products or services along with their initial purchase can help increase the overall value of each transaction.

- Upselling: Offering customers the option to upgrade to a higher-priced product or service can lead to increased revenue per customer.

- Subscription Models: Implementing subscription-based services can create a recurring revenue stream and increase customer lifetime value over time.

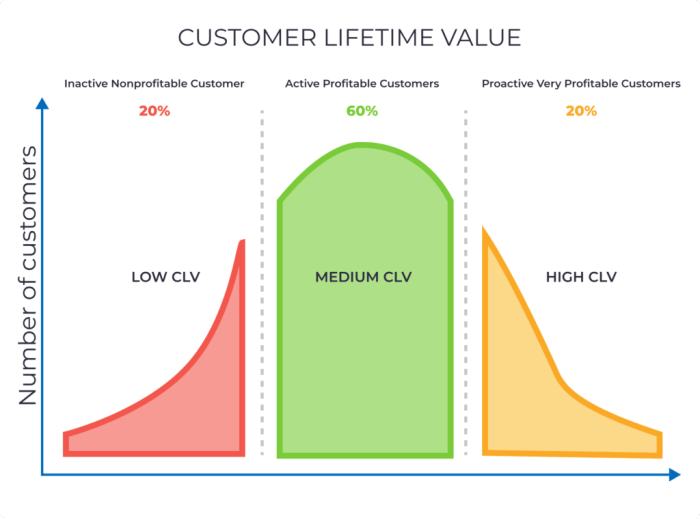

Customer Segmentation and Targeting, Understanding Lifetime Customer Value

- Customer Segmentation: Dividing customers into different groups based on demographics, behavior, or preferences allows businesses to tailor their marketing efforts and offerings to specific segments, ultimately increasing engagement and loyalty.

- Targeting: By focusing on the most valuable customer segments, businesses can allocate resources effectively and maximize the return on investment in customer acquisition and retention strategies.